Busness News, 8 March 2012 - by Mark Pownall

Busness News, 8 March 2012 - by Mark Pownall

Those investing in creating suburbia are hoping 2012 is a better year than last.

IT has been a brutal year for residential land developers as a prolonged slump in market confidence has made it tough for many to ride out the GFC and keep their bankers at bay.

New Landgate data obtained by private developer Satterley Group shows that, for land sales under 1,000 square metres, most of the key urban growth areas fell in 2011 compared to 2010, which itself was well below the average.

Looking at the key suburbs by land sales volume, where most of the top land developers have concentrated their efforts, the sight is not pretty. The Mandurah-Murray Shire is down more than 30 per cent to 679 lots sold, Baldivis is down 33 per cent to 603, Brighton 45 per cent to 342, and Harrisdale-Piara Waters 37 per cent to 429.

Running against the trend were Ellenbrook, which rose 27 per cent to 306 lots, and Landsdale, which lifted 12 per cent to 219.

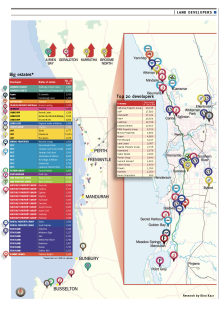

Compared to areas with big estate developments on the accompanying map, it appears that most of the major players are diversified across these regions.

Research by WA Business News for its Book of Lists (see attached) has revealed the biggest property developer in terms of estates either under construction or engaged in sales is Satterley Group with 29,435 lots. That includes several joint venture developments with government parties such as LandCorp in which Satterley is the lead partner.

According to this research, the next biggest player in Western Australia is the Danny Murphy-led LWP with 17,883 lots, followed by Stockland (17,011), Peet (16,504) and LandCorp, which has 12,765 lots as lead developer but would be a lot bigger if its partnerships were included.

The remaining players in the top 10 are Ardross Estates with 10,600 lots (primarily at a major long-term project at Jurien Bay), then Cedar Woods with 6,403 (Editor's note: in the hard copy edition and attached graphics we overlooked Cedar Woods 1,200-lot Rivergums development at Baldivis and several smaller estates as ongoing projects when we compiled this list), PRM Property Group, which has 5,700 lots (some in joint venture with east coast giant Walker Corporation), Mirvac with 4,853 lots, excluding 1,500 at Mindarie which is set to finish as a project, and Aspen with 4,580 lots. Port Bouvard is 11th with 3,217 lots.

New face

The newest entrant is Lend Lease, which broke into the WA land development market by successfully tendering to be the joint venture partner with state agency LandCorp to lead the development of Alkimos.

That signalled the next phase in competition from major national players, already represented here by Stockland, Australand and Mirvac. All of those existing national players have been rocked by the GFC, as have many of the bigger WA companies, whether they operate on a national or local stage.

Lend Lease’s biggest project, the 224-hectare 2,500-lot Alkimos development, is understood to have been delayed by the need for approvals and is still in the process of obtaining a federal environmental tick, a common complaint among developers.

It also has two other smaller LandCorp projects – redeveloping a series of primary school sites around Coolbellup and, most recently, Kwinana, in what’s being termed the Kwinana Education Precinct.

In Coolbellup, Lend Lease received approval for its local structure plan in October and hopes to start earthworks in the middle of this year.

It’s thought the development of the Kwinana Education Precinct, with 69 lots on 6.2ha, was originally won by Dale Alcock’s ABN Group.

Another newcomer is local player Spatial Property Group, which started business in 2010. It already sits just outside the top 10 players in terms of lots under development in WA.

Market conditions

Satterley Group chief Nigel Satterley believes new land sales ran at 50 per cent below the traditional underlying demand in 2011 as property buyers warily watched bad news seep out from home and abroad.

Mr Satterley confirmed the views of several property developers that 2012 was looking more promising as land and home packaging discounts, rising rental prices and lower established home stocks brought buyers back to the market – at least to the display villages.

Among his local listed competitors, Cedar Woods Properties appeared to be best positioned according to statements released to the ASX showing half-year results to the end of December.

Cedar Woods said consumer confidence was weak but claimed its development strategy was robust and its finances secure.

Peet was substantially less positive in its half-year statements, saying its strategic response to market conditions had been to preserve capital, reduce costs and be ready to take advantage of any improvement in the market.

It was also focused on debt reduction to meet a new gearing ratio of 20-30 per cent, compared to 38.8 per cent at December 31.

Port Bouvard has reduced its new land development portfolio to one major parcel, being the 3,000-lot project at Point Grey on the Peel Inlet, but slow sales of a luxury apartment development has made life difficult for management.

In its half-yearly report, Port Bouvard said it was in discussions with its bank, St George, to restructure debt to help it get past a looming working capital issue expected to occur at the end of May.

The company has a gearing ratio of around 27 per cent but much of its debt is tied up with the Oceanique apartment complex, which has inhibited its flexibility.

Port Bouvard said it also was examining other capital management strategies, including equity funding.

National property group Mirvac provides a reasonably detached perspective of the local market.

“The Western Australian residential property market remains muted, as the modest recovery in medium density dwelling construction has been offset by weaker construction of detached houses,” Mirvac said in its half-year results.

“Property prices in Perth continue to fall, although the rate of decline is starting to ease.

“Whilst short-term prospects for the residential housing market remain lacklustre, resource related activity is expected to lead to both stronger dwelling demand and prices.”